This article originally appeared in PharmaLeaders

A wave of M&A deals is coming to the healthcare industry. According to consulting firm BDO, 44% of healthcare CFOs are expecting to drive an increase in partnerships across the healthcare ecosystem and 42% are predicting further consolidation. The pandemic accelerated digital and technological transformation while exposing ineffective and archaic elements of the healthcare system. While some institutions like pharma saw financial gains from COVID-19 treatments, other organizations experienced losses, such as health systems that could not adapt to telehealth. As we emerge on the other side, some companies will look to partnerships or healthcare M&A deals to address the needs of industry transformation and grow their business. For others struck by financial hardship, they will need to reassess their core business strengths and divest any underperforming areas.

But whether expanding or consolidating, proper handling of the brand will play an important role in the deal’s success. Investors will be cautious, seeking proven business models, reliable cash flows and established brands. Customers will be wary of any new entity, or brand, that does not clearly add value in a challenging climate. And employees, having survived a major economic contraction, and subsequent layoffs, will be tired of doing more with less and may be reluctant to support unproven new ventures.

During a merger, acquisition or divestiture, healthcare companies should follow these five principles for creating a new brand that delivers greater clarity and utility for customers, investors and talent.

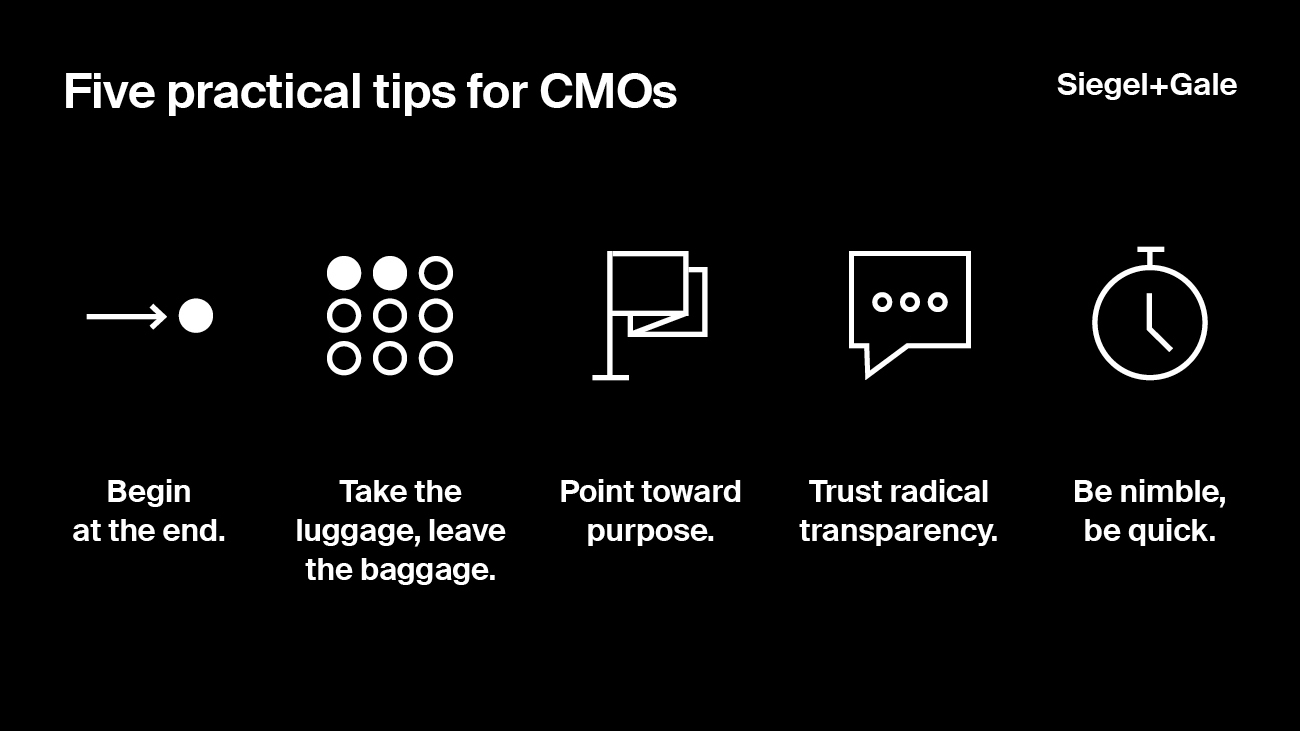

Begin at the end

Cut through the clutter. Quickly prototype “end-state” scenarios, illustrating a range of future brand portfolio models. What happens if you combine two brands, let one brand fall away or do a complete rebrand? Consider the strategic tradeoffs of each situation. Socialize these ideas with peers and leaders to start the conversation about what an optimized brand can do for the organization.

Take the luggage, leave the baggage

Take a careful inventory of all brand-related assets across the shared enterprise. This can include anything from logos and websites to training and CSR initiatives. Assess each asset for its strategic value, and decide whether to continue, evolve or retire it.

When looking at their shared future, leaders at Bristol Meyers Squibb admired the decisive culture, lean management and lack of bureaucracy of acquired bio-pharma company Celgene. They asked themselves, how far can we go to embrace a new future? Where do we need to invest? What assets and identifiers are we willing to walk away from?

After careful analysis, BMS kept its storied brand name. However, its leaders recrafted the corporate values using language drawn from each of the companies. This familiar language helped all employees embrace streamlined operating principles that were designed for agility in a changing pharma landscape. At the same time, company leaders were ready to leave behind an outdated visual identity to signal the profound change the acquisition represented. This led to a wholesale reimagination of all branded assets, which BMS implemented throughout 2020.

Point toward purpose

While deals can create chaos and uncertainly, they also create a moment to think clearly and ask vital questions: What exactly is the purpose of this new company? Who will it serve? What difference will it make in the world?

By defining and owning a powerful purpose, a newly merged company creates a touchstone across departments and initiatives, from experience design to marketing, to customer and employee value propositions. A powerful purpose can also serve acquirers as they integrate new acquisitions.

PillPack, the prescription delivery company that packages pills based on the date and time they should be taken, was being courted by several industry players, including Walgreens and Walmart. But when the company met with Amazon, the e-commerce giant shared PillPack’s feeling that dominant players in the sector didn’t put the customers first. As PillPack becomes an integral part of Amazon Pharmacy, its CEO is not only leading the prescription distributor but also helping build Amazon’s pharmacy division under the same purpose that inspired PillPack – prescription convenience with a personal touch to enhance a person’s quality of life.

Trust radical transparency

A transparent process builds trust with your most critical stakeholders. Customers feel listened to and are grateful to be part of the process. (After all, they know you and more often than not, they want you to succeed.) Properly engaged, customers are assured the new company will be built around their needs, not just those of financial engineers. Equally important, transparency lets employees feel like they have a stake in the game. They want to be part of something great, and find it motivating to have a voice in defining something so central to the organization’s future. Think of employees as co-authors of the brand, not merely an audience. Let them in. Allow them to be part of the process and give them tools to share their pride and ownership at launch.

Be nimble, be quick

CEOs have recognized that brand is an essential lever in successful M&A. The CMO is at the table with finance, operations, IT, HR and other top leaders. Keeping the seat means the pace of brand strategy and implementation must match every workstream the integration team is managing. Working at deal speed matters.

Branding activities that once took months that would “logically” run in sequence now need to be managed in days and run in tandem. Research, naming, positioning, brand architecture, logo, experience design, launch and employee engagement must all be developed on overlapping timelines.

Make sure your marketing leaders have capable teams that are comfortable with an agile process and high-speed development. These teams need institutional commitment and not insignificant resources to stay the course to the finish line.

Newly merged healthcare entities create unique opportunities to build lasting value in the industry. Post-pandemic, proper brand management during a transaction will be vital for the new entity to resonate with consumers, investors, and employees. By following these principles, brand leaders can build a new brand experience that motivates customers and mobilizes talent.

Matt Egan is Managing Director, Strategy